PRO CRITERIA:

-

FirstMetroSec PRO is open to all FirstMetroSec clients

- Trade a cumulative amount of at least P100K (buying or selling) within the month or maintain a mutual fund/stock portfolio of at least P200K

- PRO access is valid for 1 month and will be automatically renewed while criteria are met

- To check eligibility and for more information, open this link and fill out the necessary information.

PRO Video Tutorials Uploaded on Youtube

Why should active traders use FirstMetroSec PRO?

Watch the full video introduction to the series by FirstMetroSec President, Gonzalo G. Ordoñez:

Uploaded Episodes:

Episode 1: Projected Prices

Episode 2: The Various Levels of Bid and Ask

Episode 3: News and Disclosures on the Stock Info Page

View all episodes on our Youtube Channel

FIRSTMETROSEC PRO FAQs

What is FirstMetroSec PRO?

FirstMetroSec PRO is by far the most advanced online stock trading platform available for the Philippine Stock Market. The new Internet-based system is designed for active traders who need fast access to the most relevant trading information. PRO introduces features that were previously only available to industry professionals, that enable closer market monitoring, faster trading, and better portfolio management.

Is PRO available to all FirstMetroSec clients?

Access to PRO is exclusive to clients who meet minimum requirements.

What requirements are needed to gain access to PRO?

PRO is available to clients who trade at least P100k in accumulated value per month, or maintain a mutual fund/stock portfolio of at least P200k.

Once qualified, how long will it take to activate my PRO access?

Please note that batch activation of PRO accounts is done every Wednesday. You will be notified via email on your registered e-mail address.

Is there a way to check if I am eligible for PRO?

To check your eligibility, open this link. Enter your FirstMetroSec registered email address, your FirstMetroSec registered full name, and your online trading account code (OTA code).

Do I need a FirstMetroSec Account to gain access to PRO?

Yes, to be eligible for PRO, you should be an existing client of FirstMetroSec.

Is there an expiration date on my PRO access?

PRO access is valid for one (1) month unless stated otherwise.

What are some of the new benefits/features of FirstMetroSec PRO?

Overall User Interface

- Enhanced User Interface

- Color theme – dark mode/light mode

- Breakdown of Daily Market Performance – including local and foreign participation, net buying and selling

- Sub-indices charts

- Create and save up to 5 watchlists

- Create and save up to 5 multiple bid-ask displays

- View market pressure

- Consolidated portfolio of your stocks, mutual funds, and cash

- Volume weighted average stock price

- Other enhancements on stock info

- Projected open/close prices

- Full Market Depth display

- Order Book Display

- Consensus stock price target

- Consensus stock rating

- Enhanced research report pages

- Dynamic Charts

- Chart Pattern Recognition

- Interactive Charts

Can I withdraw my funds through PRO?

Yes, you can withdraw funds through both the standard site and PRO platforms.

Can I log in to the classic site and PRO at the same time?

You can only log in and use either of one of the two trading platforms at a time.

Are there fees for using the PRO platform?

PRO access is free of any fees for eligible clients.

I currently cannot meet your existing criteria, is there a subscription plan for PRO?

We are currently working on PRO’s pricing model. Please stay tuned for announcements.

Is there a mobile app for PRO?

We are currently developing a new app for PRO. Please stay tuned for announcements.

Are there only hours to access PRO?

Access to PRO is available 24/7, anytime, anywhere.

Where can I see tutorial videos for PRO?

Tutorial videos for PRO are posted on our Facebook Page and YouTube Channel. Please follow our other social media platforms to receive announcements and updates.

Do you have Webinars or Seminars on PRO tutorial?

Yes, please visit http://www.bit.ly/FMSeminars for the full schedule of all our seminars and events

CONDITIONAL ORDERS

Conditional orders allow you to preset the conditions that will trigger the purchase or sale of stocks, so you can execute your plan precisely even when you are not watching the market.

Learn more about Conditional Orders HERE.

FREQUENTLY ASKED QUESTIONS:

Can we use Conditional Orders for free?

Yes. Stop Limit and Limit-if-Touched are available on FirstMetroSec NEW, GO, and PRO, while Order-Cancels-Other and Order-Triggers-Other are available on PRO only.

What happens once my Conditional Order gets triggered?

Once your conditional order has been triggered, the resulting limit order will be posted. It has to be filled until the remaining time/days of your trigger expiry.

For example, your Stop Limit with a GTW Trigger Expiry has been triggered. Your limit order will be activated and shall remain open for matching until the remaining days of the GTW.

Can I cancel a Conditional Order?

Yes. During trading hours, conditional orders can be cancelled in the Conditional Orders Tab, as long as they have not been triggered yet.

How to set the Limit Price and Target Price?

| BUY | SELL | |

| Stop Limit | Trigger Price > Last Price The placement of the Limit Price depends on your strategy:

|

Trigger Price < Last Price The placement of the Limit Price depends on your strategy:

|

| Limit-if-touched | Trigger Price < Last Price The placement of the Limit Price depends on your strategy:

|

Trigger Price > Last Price The Limit Price depends on your strategy:

|

| Oder-Cancels-Other | Stop Limit: Trigger Price > Last Price LIT: Trigger Price < Last Price The placement of the Limit Price depends on your strategy |

Stop Limit: Trigger Price < Last Price LIT: Trigger Price > Last Price The placement of the Limit Price depends on your strategy. |

| Order-Triggers-Other | Buy (Primary) Limit Price: Any price, depending on your strategy Sell (Secondary) Limit Price: Higher than the Buy Price |

Sell (Primary) Limit Price: Any price, depending on your strategy Buy (Secondary) Limit Price: Lower than the Sell Price |

How do I know the status of my Stop Limit Order?

How do I know the status of my stop limit order?

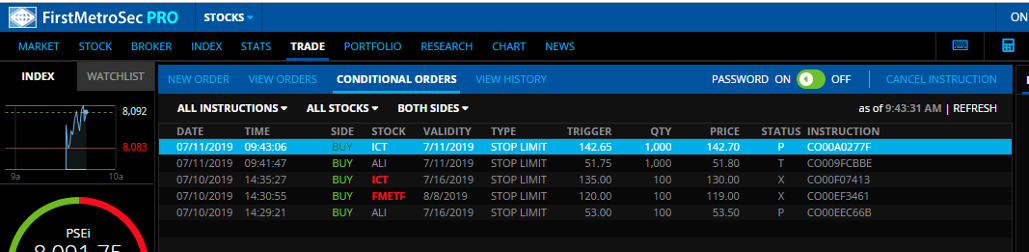

To check the status of your pending Stop Limit orders on FirstMetroSec PRO, go to TRADE > CONDITIONAL ORDERS:

P – Pending: stock has not hit your Trigger Price

T – Triggered: stock has hit your Trigger Price

X – Rejected: system has rejected your order

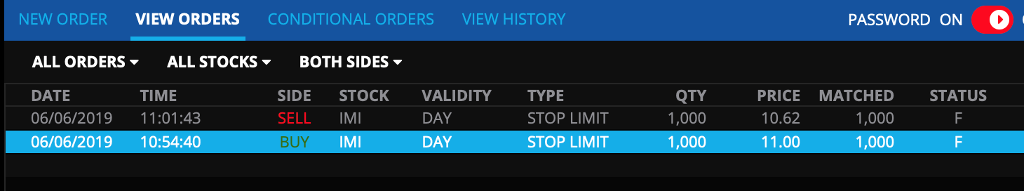

Then, to check the status of the limit orders after getting triggered, go to Trade > View Orders:

O – Open: posted order

PF – Partially Filled: partial volume has been matched

C – Cancelled

F – Filled: matched order

X – Rejected

Q – Queued: prompts before order is processed

PRC – Processing: order is being sent to/acknowledged by the Exchange

CHARTING TOOLS

1. Dynamic Chart by Technistock – The Dynamic Chart by Technistock on the FirstMetroSec trading platform provides a diverse set of charting features and functionalities. It includes interactive charts, drawing tools, technical indicators, and customization options. What sets the Dynamic Chart apart is the real-time data updates. This ensures that users have access to the latest market information, enabling timely analysis and decision-making.

2. Interactive Chart by TradingView– This chart is provided by TradingView, a sophisticated charting and analysis platform used by traders and investors worldwide. It offers a wide range of charting features and tools to analyze financial markets, such as interactive and customizable charts, various drawing tools, technical analysis gauge, and a vast selection of technical indicators.

3. Chart Pattern Recognition by Trading Central – Chart Pattern Recognition by Trading Central is a widely recognized technical analysis tool. Trading Central specializes in advanced chart pattern recognition and automated technical analysis. By utilizing sophisticated algorithms, their system scans market data to identify specific chart patterns such as triangles, head and shoulders, double tops, and more. Traders benefit from Trading Central's services as they quickly identify potential trend reversals or continuation patterns, enabling them to seize trading opportunities based on these valuable market signals.

To learn more about Chart Pattern Recognition, click HERE.